Why Companies Choose to Form Joint Ventures

Exploring why companies form international joint ventures and how those motives influence their structure and success.

Part 3 of the IJV Fundamentals series on international joint ventures. This article builds on Part 1 and Part 2.

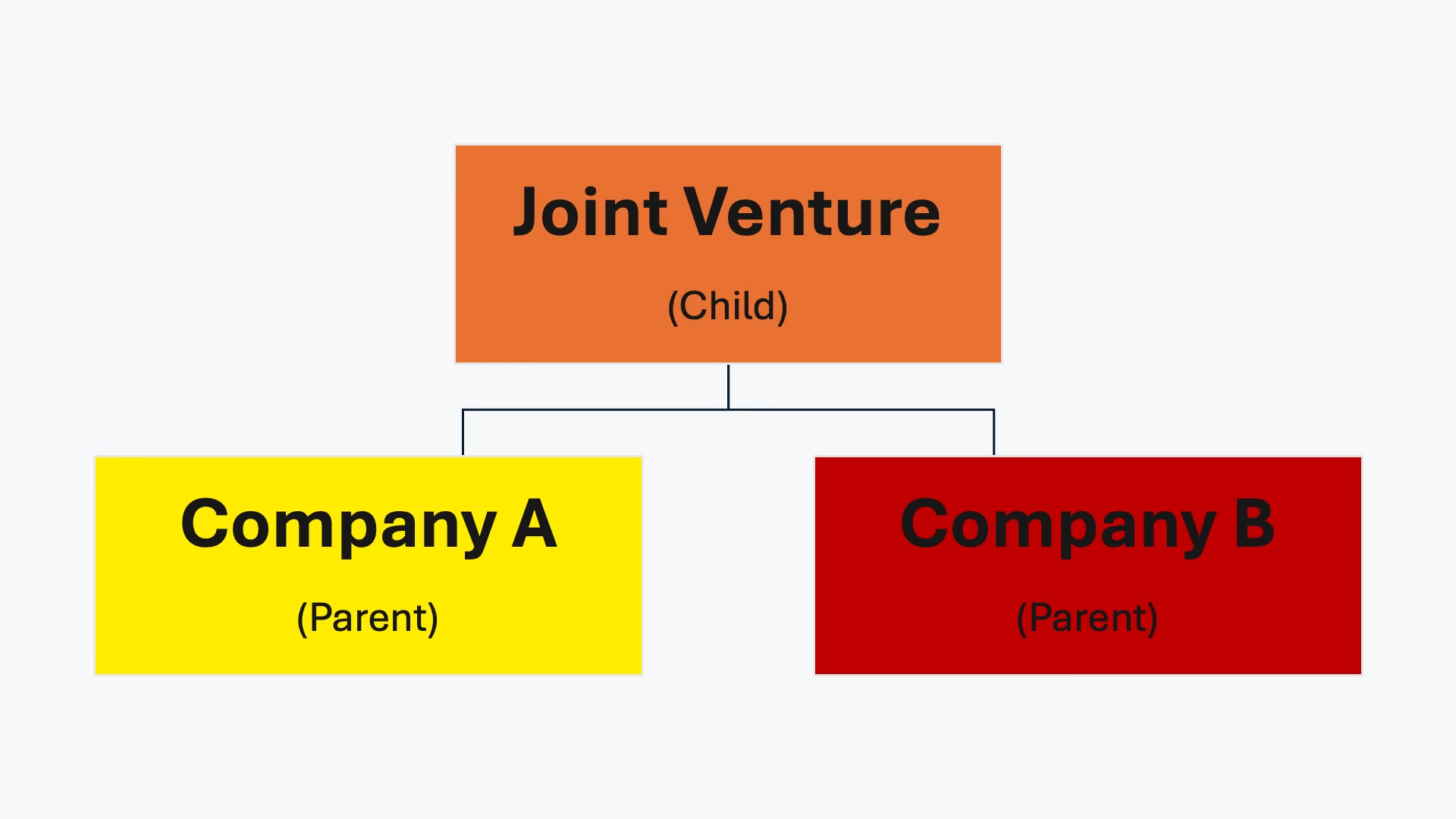

Having defined what an international joint venture is and explored the main types of structures, the next question is why companies choose to form them in the first place. Joint ventures represent a deliberate strategic choice. The motivations behind a joint venture often determine its design and long-term viability.

Market Access and Expansion

Market entry remains one of the most common drivers of joint venture formation.Partnering with a local firm enables companies to navigate barriers such as complex regulatory environments, underdeveloped distribution infrastructure, and cultural unfamiliarity. The local partner typically contributes market knowledge, established relationships, and regulatory expertise, while the foreign partner brings capital, proprietary technology, or brand equity. This complementary approach reduces entry risk and accelerates market penetration.

Risk Sharing and Cost Distribution

Capital-intensive projects frequently exceed the financial capacity or risk tolerance of a single firm. Joint ventures provide a mechanism for distributing both investment requirements and exposure to risk. This is particularly valuable in uncertain environments characterized by political volatility, demand fluctuations, or regulatory unpredictability. Through risk sharing, partners establish a more sustainable platform for ambitious undertakings that might otherwise be infeasible.

Resource and Capability Complementarity

The strategic logic of many joint ventures centers on the distinct assets each partner contributes. A firm with advanced technological capabilities may partner with one possessing manufacturing scale or established distribution channels. By combining differentiated resources, joint ventures generate value unattainable by either party independently. This complementarity is often a decisive factor in industries where competitive advantage depends on both specialization and speed to market.

Innovation and Knowledge Transfer

Joint ventures also function as drivers for innovation and organizational learning. By pooling research capabilities or jointly developing products, partners can accelerate innovation cycles while distributing development costs. Simultaneously, joint ventures create opportunities for strategic learning, enabling partners to gain insights into each other’s operational processes, management practices, and market strategies. In sectors such as biotechnology, renewable energy, and advanced manufacturing, this knowledge transfer rivals immediate financial returns in strategic importance.

Competitive Positioning and Strategic Flexibility

Companies also form joint ventures to strengthen their competitive positioning. A joint venture may preempt competitors’ access to key markets, establish presence in emerging sectors, or serve as a preliminary step toward an eventual merger or acquisition. In industries experiencing rapid consolidation, joint ventures offer strategic flexibility by enabling firms to build alliances and test compatibility without committing to full integration.

Conclusion

The decision to form a joint venture extends beyond structural considerations to encompass fundamental strategic intent. Motivations such as market access, risk mitigation, resource complementarity, innovation acceleration, and competitive positioning shape the joint venture’s organizational form, governance framework, and long-term sustainability. Recognizing these strategic drivers ensures that a joint venture’s purpose and structure remain aligned over time.