What is an International Joint Venture?

A brief introduction to international joint ventures.

Part 1 of the IJV Fundamentals series on international joint ventures.

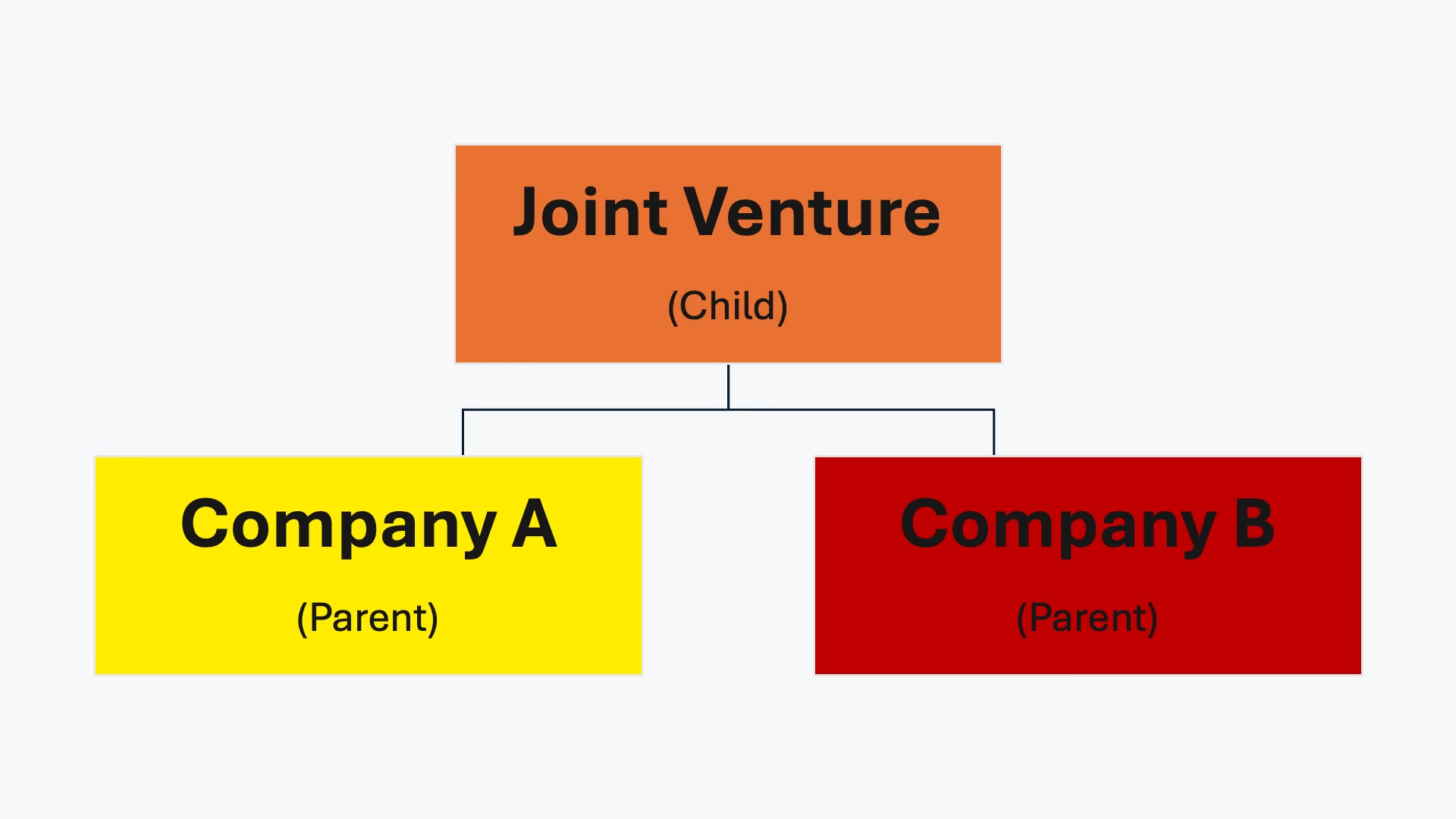

There is no single, universally accepted definition of an international joint venture. Business professionals may describe an international joint venture as a strategic partnership in which companies from different countries combine their resources and capabilities to pursue shared business goals through a jointly owned enterprise.

Legal professionals may describe an international joint venture as a cross-border contractual or equity-based arrangement between two or more legally distinct entities that form a separate business entity.

In practice, the term refers to a wide range of cooperative business arrangements formed by two or more parties across borders. Some involve shared equity and formal legal entities. Others are governed primarily by contract. Regardless of form, international joint ventures are shaped by expectations, strategy, and structure.

Why are International Joint Ventures Formed?

International joint ventures are formed to achieve strategic objectives that would be difficult or inefficient to pursue independently. These objectives may include gaining access to new markets, sharing costs and risks, acquiring local knowledge, navigating regulatory environments, or combining complementary technologies and expertise. Partnering with a local or foreign entity can enhance competitive positioning, accelerate growth, and increase operational efficiency while distributing legal, financial, and logistical responsibilities.

Agreement is not Enough

A well-drafted joint venture agreement typically addresses equity distribution, profit-sharing, decision-making structures, intellectual property, termination provisions, and dispute resolution clauses.

Cultural factors often shape how joint venture partners approach disagreement and risk. For more on this, see Cultural Considerations in Dispute Resolution Clauses.

Yet, even the most well-drafted agreement will not prevent breakdowns. Many cross-border joint ventures fail because the expectations behind the clauses were fundamentally misaligned. One party may interpret “joint control” as consensus on key decisions, while the other may interpret it as autonomy unless told otherwise. Although both perspectives may be defensible, strategically, they pose a significant risk.

Culture as Structure

Cultural intelligence encompasses the ability to understand how norms, values, and assumptions influence business conduct. In international joint ventures, cultural intelligence assumes a structural role.

Consider a joint venture between a German industrial firm and a Turkish logistics partner. The German team may value procedural precision and documented processes. The Turkish side may prioritize relationships and improvisation. Neither approach is inherently flawed, but if unacknowledged, both parties will begin interpreting each other’s behavior as careless or rigid.

In East Asian ventures, cultural expectations surrounding hierarchy, indirect communication, and long-term relational investment can significantly impact the perception of “jointness” within the venture, irrespective of the contractual stipulations.

Why Most International Joint Ventures Fail

Studies indicate that between 40% and 70% of cross-border joint ventures underperform or are dissolved within five years. While some failures are commercial in nature, others are legal. However, the majority can be attributed to unspoken assumptions regarding authority, trust, and decision-making processes.

The legal system anticipates disputes but rarely anticipates mistrust stemming from tone, decision fatigue arising from incompatible working styles, or the erosion of goodwill due to perceived slights across cultural boundaries.

A successful international joint venture must integrate legal clarity, strategic alignment, and cultural fluency. No clause can substitute for that.

Towards a Strategic Perspective

To think strategically about international joint ventures is to consider factors beyond enforceability. While legal tools are indispensable, they are reactive. Executives often focus on control, but control without alignment becomes ineffective.

A successful joint venture must integrate all three layers: legal clarity, strategic alignment, and cultural fluency. This necessitates a form of intelligence that no clause can substitute.